| | | Members | | | | | | 2023 ANNUAL PROXY STATEMENT |

| | Primary Responsibilities | | Nominating and Corporate Governance CommitteeNOMINATING AND CORPORATE GOVERNANCE COMMITTEE | | | | Members:

Robin L. Newmark (Chair) Richard E. Perlman James K. Price Janet Risi Field (as of January 1, 2024) | | Primary Responsibilities

Our Nominating and Corporate Governance committeeCommittee oversees all aspects of our corporate governance functions. These responsibilities include engaging in succession planning for the Board, identifying individuals qualified to become Board members (consistent with criteria approved by the Board), developing and recommending to the Board a set of corporate governance principles and performing a leadership role in shaping the Company’s corporate governance. The Nominating and Corporate Governance Committee also oversees our Board and committee evaluation processes and makes recommendations to our Board of Directors regarding director candidates and assists our Board of Directors in determining the composition of our Board of Directors and its Committees. The qualifications thatCommittees, as discussed in “Review of Director Nominees” above. In addition, the NominatingCommittee generally oversees the Company’s stockholder engagement program and Corporate Governance Committeeoversees and makes recommendations to the Board consider in identifying qualified candidatesregarding sustainability matters relevant to serve as directors include, among others, the ability to uphold the Company’s mission, skills (such as financial backgroundbusiness, including Company policies, activities and abilities and the other specific sills described in “The Board of Directors—Director Skills and Experience”), education, professional, scientific and academic affiliations, experience, age, length of service, positions held, and geographies served. The Nominating and Corporate Governance Committee also considers diversity of viewpoints, backgrounds, experience and other demographics, including race and ethnicity and gender, for which the Board will proactively seek diversity when considering any new candidates, in evaluating director candidates and how they can contribute to the overall composition of the Board and will also consider director candidates recommended by stockholders. The Nominating and Corporate Governance Committee assesses the effectiveness of its efforts at pursuing diversity across these measures as part of evaluating the composition of the Board. Once potential candidates are identified (including those candidates recommended by stockholders), the Nominating and Corporate Governance Committee reviews the backgrounds of those candidates. Final candidates are then chosen and interviewed by other Board or management representatives. Based on the interviews, the Nominating and Corporate Governance Committee then makes its recommendation to the Board. If the Board approves the recommendation, the candidate is nominated for election. The Nominating and Corporate Governance Committee may also consult with outside advisors or retain search firms to assist in the search for qualified candidates. Stockholders interested in making recommendations of director candidates should contact the Nominating and Corporate Governance Committee as described below under “Contacting the Board of Directors.”opportunities. At all times during the fiscal year ended December 31, 2022,2023, the Nominating and Corporate Governance Committee has been comprisedcomposed entirely of independent directors as required by NYSE rules. The Nominating and Governance Committee held sixtwo meetings in fiscal 2022.2023. |

| | | | | | | | | | | | | 2023 ANNUAL PROXY STATEMENT |

Committee Charters The Board of Directors has adopted formal charters for each of its three standing Committees. These charters establish the missions of the respective Committees as well as Committee membership guidelines. They also define the purpose, duties, and responsibilities of each Committee in relation to the Committee’s role in supporting the Board of Directors and assisting the Board in discharging its duties in supervising and governing the Company. The charters are available on the Company’s website at www.montrose-env.com by following the links to “Investors” and “Corporate Governance” or upon written request to the Company, as set forth under “Availability of Documents” below. The Board’s Role in Risk Oversight

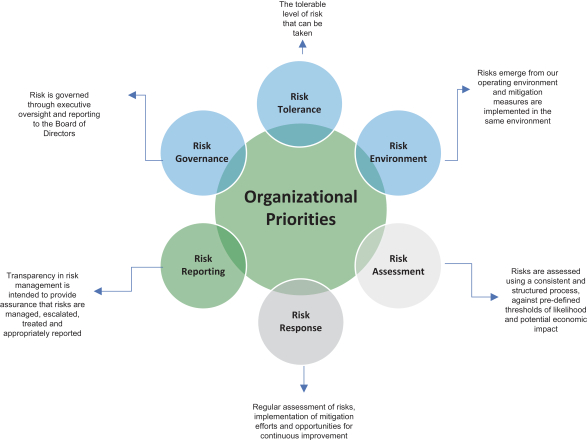

The Board of Directors oversees the Company’s risk management process. The Board oversees a Company-wide approach to risk management, designed to enhance stockholder value, support the achievement of strategic objectives and improve long-term organizational performance. The Board determines the appropriate level of risk for the Company generally, assesses the specific risks faced by the Company and reviews the steps taken by management to manage those risks. The Board’s involvement in setting the Company’s business strategy facilitates these assessments and reviews, culminating in the development of a strategy that reflects both the Board’s and management’s consensus as to appropriate levels of risk and the appropriate measures to manage those risks. Pursuant to this structure, risk is assessed throughout the enterprise, focusing on risks arising out of various aspects of the Company’s strategy and the implementation of that strategy, including financial, legal/compliance, operational/strategic, health and safety, and compensation risks. The Board as a whole also considers risk when evaluating proposed transactions and other matters presented to the Board, including acquisitions and financial matters.

While the Board maintains the ultimate oversight responsibility for the risk management process, its Committees oversee risk in certain specified areas. In particular, the Audit Committee reviews and discusses the Company’s practices with respect to risk assessment and risk management. The Audit Committee also focuses on financial risk, including internal controls, and discusses the Company’s risk profile with the Company’s independent registered public accounting firm and our internal audit function, which conducts an annual risk assessment that is presented to the Audit Committee and the Board. In addition, the Audit Committee oversees the Company’s compliance program with respect to legal and regulatory requirements, including the Company’s codes of conduct and policies and procedures for monitoring compliance and, along with the Board, is briefed periodically regarding cybersecurity risk. The Compensation Committee periodically reviews compensation practices and policies to determine whether they encourage excessive risk taking, including a periodic review of management’s assessment of the risk associated with the Company’s compensation programs covering its employees, including executives, and discusses the concept of risk as it relates to the Company’s compensation programs. Finally, the Nominating and Corporate Governance Committee manages risks associated with the independence of directors and Board nominees, as well as risks related to the Company’s environmental, social and governance practices. Management regularly reports on applicable risks to the relevant Committee or the Board, as appropriate, including reports on significant Company projects, with additional review or reporting on risks being conducted as needed or as requested by the Board and its Committees.

Audit Committee Oversight of Cybersecurity

As part of the Audit Committee’s role in overseeing risks related to the Company’s cybersecurity program, the Audit Committee has engaged a third-party expert to advise the Audit Committee and

| | | | | | | | | | | | | 2023 ANNUAL PROXY STATEMENT |

Board on cybersecurity matters, including oversight of the Company’s continued development, evolution and investments in cybersecurity policies, practices and resources. The Audit Committee receives reports on cybersecurity and related risk exposures from management on a quarterly basis, or more frequently if requested by the Audit Committee. The Audit Committee regularly updates the Board on such matters and the Board also periodically receives reports from management directly, as the Audit Committee determines appropriate or requested by the Board.

As part of our cybersecurity policies and practices, all employees are required to complete annual cybersecurity training. We also assess the efficacy of our information security program through internal detection and monitoring systems, as well as through the engagement of external, third-party experts. Our current cybersecurity risk program is aligned with various frameworks, including NIST 800-171.

Nominating and Corporate Governance Committee Oversight of ESG Matters

We believe that achieving and sustaining business excellence is intrinsically tied to understanding our stakeholders’ expectations, acting responsibly as we strive to meet those expectations, and committing to transparency and accountability. As such, we strive to understand, evaluate and address our environmental, social, and governance (ESG) risks, opportunities, and impacts, a practice we believe is foundational to generating value for our stakeholders. As part of our commitment to ESG matters, our Board actively oversees our ESG strategies and progress towards meeting our ESG-related commitments. In addition to creating an ESG working group in 2020 and the hiring of independent ESG auditors to validate the ESG data we report, our Nominating and Corporate Governance Committee is responsible for overseeing our overall ESG performance, disclosure, strategies, goals and objectives and monitoring evolving ESG risks. In carrying out its responsibilities, the Nominating and Corporate Governance Committee receives periodic updates from management and representatives from the ESG working group on the Company’s ESG efforts and reviews and makes recommendations to our Board regarding the Company’s ESG-related commitments, as well as reviewing our annual ESG reporting, which demonstrates our commitment to transparency and accountability of our goals and progress.

Compensation Committee Interlocks and Insider Participation Our Compensation Committee is composed of Peter M. Graham, Richard E. Perlman, J. Thomas Presby, and James K. Price. None of our executive officers currently serves, or has served during the last completed fiscal year, as a member of the board of directors, or as a member of the compensation or similar committee, of any entity that has one or more executive officers who served on our board of directors. For a description of the transactions between us and members of the Compensation Committee, see the transactions described in the section entitled “Certain Relationships and Related Party Transactions.” Codes of Ethics

In addition to the Principles of Corporate Governance, the Board of Directors has adopted a Code of Ethics and Business Conduct applicable to employees and a Code of Ethics and Business Conduct applicable to the Board. These Codes of Ethics, along with the Principles of Corporate Governance, serve as the foundation for the Company’s system of corporate governance. They also provide guidance for maintaining ethical behavior, require that directors and employees comply with applicable laws and regulations, prohibit conflicts of interest and provide mechanisms for reporting violations of the Company’s policies and procedures.

| | | | | | | | | | | | | 2023 ANNUAL PROXY STATEMENT |

In the event the Company makes any amendment to, or grants any waiver from, a provision of the Code of Ethics that applies to the principal executive officer, principal financial officer or principal accounting officer that requires disclosure under applicable SEC or NYSE rules, the Company will disclose such amendment or waiver and the reasons therefor on its website at www.montrose-env.com.

Availability of Documents The full text of the Principles of Corporate Governance, the Codes of Ethics and Business Conduct and the Charters of the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee are accessible by following the links to “Investors” and “Governance” on the Company’s website at www.montrose-env.com. The Company will furnish without charge a copy of the foregoing to any person making such a request in writing and stating that he or she is a beneficial owner of common stock of the Company. Requests should be addressed to: Montrose Environmental Group, Inc., 5120 Northshore Drive, North Little Rock, AR 72118, Attention: Investor Relations. | |

|

| | | | | | | | | | | |

| | | | | | | | | | 26 | | |

2024 ANNUAL PROXY STATEMENT Contacting the Board of Directors You can contact an individual director, the Board of Directors as a group or a specified Board Committee or group, including the non-management directors as a group, to provide comments, to report concerns, to make recommendations regarding candidates for director, or to ask a question, by writing to the following address: Corporate Secretary, Montrose Environmental Group, Inc., 5120 Northshore Drive, North Little Rock, AR 72118, noting to whose attention the communication should be directed. You may submit your concern anonymously or confidentially. You may also indicate whether you are a stockholder, customer, supplier or other interested party. Communications are distributed to the Board, to a Board committee, or to any individual directors or groups of directors as appropriate, depending on the facts and circumstances outlined in the communication. In that regard, the Board of Directors has requested that our Corporate Secretary review correspondence directed to the Board and not forward certain items which are unrelated to the duties and responsibilities of the Board, such as service complaints, service inquiries, resumes and other forms of job inquiries, surveys and business solicitations or advertisements. In addition, material that is unduly hostile, threatening, illegal or similarly inappropriate will be excluded. Any communication that is filtered out will be made available to any director upon request. Director Compensation

Our non-management directors are eligible to receive compensation for their services on our Board of Directors and its committees in the form of cash retainers and restricted stock awards (provided that, for the portion of fiscal year 2022 in which Mr. Jonna served on our board, Oaktree Capital Management, L.P. (“Oaktree”), the holder of our Cumulative Series A-2 Preferred Stock, in lieu of Mr. Jonna, received cash in lieu of the restricted stock awards as described in more detail below). After consideration of peer group director compensation programs provided by Aon, our independent compensation advisor, and the time and effort dedicated by directors to their positions on our Board, on December 16, 2021, our Board approved the annual compensation packages for our non-management directors for their service on our Board of Directors and its committees for the fiscal year ended December 31, 2022 as set forth below. The Board reviewed the non-management director compensation program again for the fiscal year ended December 31, 2023 and determined not to make any further changes.

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | 27 | | |

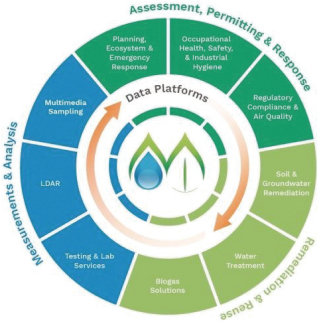

2024 ANNUAL PROXY STATEMENT Corporate Sustainability Our Approach to Sustainability At Montrose, we believe that achieving our long-term business strategies means striving for continual improvement and accounting for the sustainability elements most relevant to Montrose. We actively manage many different aspects of sustainability, including caring for our employees, serving our communities, positively impacting the environment, and effecting change while at the same time focusing on value creation for our stockholders through effective and innovative services, good governance, and integrity. We view sustainability as mission critical. Our sustainability approach encompasses some of the most relevant environmental, social, and governance factors to our business, stakeholders, and employees, including our comprehensive and consistent approach to helping our clients – the One Montrose way. We believe these areas are interconnected and active management of each generates sustainable value. Addressing the Sustainability Issues Material1 to our Business and our Stakeholders Identifying and evaluating the factors most relevant to Montrose and our stakeholders is integral to our sustainability strategy. In 2022, we conducted our first formal materiality assessment to better understand the expectations of our internal and external stakeholders, our impacts, our risks, and our business opportunities. This assessment provided focus and is used to inform our sustainability strategy, activities, and allocation of resources. The materiality assessment was informed by (1) research and peer benchmarking to better understand relevant sustainability issues, (2) interviews with Montrose business leaders and external stakeholders to further understand expectations and priorities, and (3) relevant aspects of frameworks such as Sustainability Accounting Standards Board (SASB, which is now part of the International Financial Reporting Standards Foundation) Sustainability Accounting Standard. As a result of the assessment, we identified the following factors as what we believe are most material to our long-term sustainability as a business: | | | • | | Page-12 Energy Use and Greenhouse Gas (GHG) Emissions

| |

| • | | Diversity, Fairness, and Inclusion | |

| • | | Attracting, Engaging, and Retaining Talent | |

Additional information about these areas is provided below. Overall, our material topics guide our sustainability strategy, assist us in identifying program priorities and enhancements, and inform our sustainability reporting and disclosures. We are committed to continuing to improve and recognize that the landscape of these disclosures is dynamic; as our business grows, we will engage with both internal and external stakeholders and routinely update our strategy and reporting to account for these changes. We anticipate formally updating our materiality assessment in 2025. 1 Any issues identified as material for purposes of our sustainability strategy and sustainability materiality assessment may not be considered material for SEC reporting purposes. Within the context of our approach to sustainability as discussed in this section, the term “material” is distinct from, and should not be confused with, such term as defined for SEC reporting purposes. | |

|

| | | | | | | | | | | | | |

| | | | | | | | | | | | 2023 ANNUAL PROXY STATEMENT |

| | | | | | | | | | | | | | | | | | 2021 Director

Compensation ($) | | 2022 Director

Compensation ($) | | | | | Annual Cash Retainer | | 75,000(1) | | 90,000(1) | | | | | Annual Equity Grant | | 75,000(2) | | 110,000(2)(3) | | | | | Total Base Compensation | | 150,000 | | 200,000 | | | | | Committee Chair Cash Retainers | | | | | | | | | • Audit | | 10,000 | | 50,000 | | | | | • Compensation | | 7,500 | | 30,000 | | | | | • Nominating and Corporate Governance | | 5,000 | | 10,000 | | | | | Non-Executive Chair Cash Retainer | | 50,000 | | 80,000 |

(1) | Annual cash retainers are paid quarterly, in arrears.28

|

(2) | Our non-management directors receive an award of restricted stock, with the number of shares determined by dividing the annual equity grant amount by the closing price of our common stock on the date of the grant (or the prior trading date, if the date of grant falls on a non-trading day); residual amounts resulting from rounding to whole shares are paid in cash. All restricted stock granted to our non-management directors vest on the one-year anniversary from the date of grant.

|

(3) | Mr. Jonna served on the Board pursuant to the right of Oaktree to appoint a director as set forth in the Certificate of Designation of Cumulative Series A-2 Preferred Stock. The value of the annual equity grant payable to Mr. Jonna, the former Oaktree designee who stepped down from our Board on June 10, 2022 in connection with his departure from Oaktree, was to be made in cash rather than in equity, given that all director compensation payable to Mr. Jonna was immediately transferred to Oaktree. Oaktree has not appointed a new director to replace Mr. Jonna.

|

Our directors are reimbursed for travel, food, lodging and other expenses directly related to their activities as directors. Our directors are also entitled to the protection provided by the indemnification provisions in our bylaws and the indemnification agreements entered into with the directors. Our Board may revise the compensation arrangements for our directors from time to time.

2024 ANNUAL PROXY STATEMENT Climate Change Impact and Risk Due to the nature of our business, our operations have a relatively small GHG impact as compared to many industries. However, our business itself can have a significant impact on addressing climate change through the services we offer our clients, many of whom are in carbon-intensive industries. For example, we help clients develop and execute strategies to transition to a lower-carbon future. Our day-to-day focus is on meeting clients’ objectives of reducing environmental impacts from their operations, conserving natural resources, and achieving environmental performance goals. That said, we are aware that we must also understand and address our own climate impacts. As noted above, energy use and GHG emissions was identified as one of our material sustainability factors. In our most recent 2022 Sustainability Report (published in 2023), we disclosed our global Scope 1 and Scope 2 GHG emissions, and, for the first time, we calculated and reported our Scope 3 GHG emissions. Understanding our Scope 3 footprint allows us to identify material sources of emissions across the value chain and evaluate the resiliency of our supply chain. Beyond understanding our impact, we are setting goals and targets to reduce our GHG emissions. We announced our commitment to achieve net zero GHG emissions by 2040 in our 2022 Sustainability Report. Since that announcement, we have committed to near-term and net-zero targets via the Science Based Target Initiative (SBTi). While it is important that we understand and manage our impacts on climate change via our GHG emissions, we also understand that climate change presents both risks and opportunities for us as an organization. As part of our enterprise risk management processes and business strategy, we have identified climate-related risks and opportunities for Montrose. These are reported in our 2022 Sustainability Report, as well as through the CDP Climate Change questionnaire. As our sustainability program evolves, we will continue to identify, assess, manage, and report on our climate-related risks and opportunities. Protecting the Environment through Business Solutions Montrose’s mission is to help protect the air we breathe, the water we drink, and the soil that feeds us. We take pride in our ability to generate positive impacts on the environment and for our communities. By helping shape the future of environmental solutions, we remain steadfast in our commitment to create positive change. Our industry-recognized solutions include monitoring and enhancing water and air quality, restoring ecosystems, reducing GHG emissions in support of the transition to a low-carbon economy, emergency environmental response, and more. In the dynamic field of environmental consulting and solutions, our distinctive One Montrose approach sets us apart. It encompasses holistic, coordinated, and diversified environmental services that address present realities and future priorities. The services we provide can help our clients comply with environmental regulations, reduce their environmental impact, and manage environmental risk, which ultimately contributes to value creation for our stakeholders. We’ve invested in assets and cutting-edge technologies to keep us and our clients informed about emerging environmental challenges. At Montrose, innovation lies at the core of our business strategy and operations. To that end, we stand firm in our commitment to researching new technologies and developing new solutions to address the dynamic world of environmental challenges. We innovate with the aim of providing our clients with better solutions to meet their environmental needs and make a positive impact on the environment and society at large. | | | | | Page-13

| | | | | |

|

| | | | | | | | | | | | | |

| | | | | | | | | | | | 2023 ANNUAL PROXY STATEMENT |

The following table sets forth the compensation earned by our non-management directors for the fiscal year ended December 31, 2022.

| | | | | | | | | | | | | | | | | | | | | Name | | Fees earned or paid in

cash ($) | | Stock Awards

($)(1)(2) | | Total ($) | | | | | | J. Miguel Fernandez de Castro | | 90,004 | | 109,995 | | 200,000 | | | | | | Peter M. Graham | | 120,004 | | 109,995 | | 230,000 | | | | | | Peter Jonna(3) | | 50,000 | | — | | 50,000 | | | | | | Robin L. Newmark | | 100,004 | | 109,995 | | 210,000 | | | | | | Richard E. Perlman | | 170,004 | | 109,995 | | 280,000 | | | | | | J. Thomas Presby | | 140,004 | | 109,995 | | 250,000 | | | | | | James K Price | | 90,004 | | 109,995 | | 200,000 | | | | | | Janet Risi Field | | 90,004 | | 109,995 | | 200,000 |

(1) | Represents the aggregate grant date fair value of the award of restricted stock granted under the Company’s Amended and Restated 2017 Stock Incentive Plan (the “Stock Plan”) in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718, Stock Compensation (“ASC 718”). The fair value reported equals the number of restricted shares granted, which was 1,560, multiplied by the closing price of the Company’s common stock of $70.51 per share on December 31, 2021, the trading day immediately prior to the date of grant.29

|

(2) | The following table sets forth the aggregate number of stock awards and stock options outstanding as of December 31, 2022:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | Name | | Aggregate Shares Subject to Outstanding Stock Awards (#)(a) | | Number of

Securities

Underlying

Unexercised

Options (#)

Exercisable(b) | | Number of

Securities

Underlying

Unexercised

Options (#)

Unexercisable | | | | | | | | | J. Miguel Fernandez de Castro | | 1,560 | | — | | — | | | | | | | | | Peter M. Graham | | 1,560 | | — | | — | | | | | | | | | Peter Jonna | | — | | — | | — | | | | | | | | | Robin L. Newmark | | 1,560 | | — | | — | | | | | | | | | Richard E. Perlman | | 1,560 | | — | | — | | | | | | | | | J. Thomas Presby | | 1,560 | | 10,000 | | — | | | | | | | | | James K Price | | 1,560 | | — | | — | | | | | | | | | Janet Risi Field | | 1,560 | | — | | — | | |

| (a) | All 1,560 of the shares reported for each director are shares of restricted stock that vested on January 1, 2023.

|

| (b) | Stock options have an exercise price of $9.76 per share of common stock and are fully vested.

|

2024 ANNUAL PROXY STATEMENT Nominating and Corporate Governance Committee Oversight of Sustainability Matters Our Board’s Nominating and Corporate Governance Committee is responsible for sustainability oversight, including overall sustainability performance, goals, and objectives. The Nominating and Corporate Governance Committee monitors the evolving sustainability risks most relevant to Montrose in addition to oversight of our sustainability policies and annual disclosures. Our Nominating and Corporate Governance Committee receives regular updates from our Executive Leadership and advises on sustainability program priorities. Additionally, the committee makes recommendations to our Board regarding sustainability-related commitments and reviews our annual sustainability report. Human Capital Resources We believe one of our greatest strengths is our employees who strive to innovate and deliver unparalleled service to our clients and communities. Our employees are passionate about the environment and supporting one another. We are committed to fostering a diverse, fair and inclusive workplace with a focus on respect, trust and belonging. We invest in the success and development of our employees and maintain people-centric strategies from recruiting, engagement, development, compensation and benefits to safety and communication. Employees As of December 31, 2023, we had approximately 3,100 employees (which includes full-time, part-time and stand-by environmental emergency response personnel). Approximately 2,400, or 77%, of our employees work in our U.S. operations and approximately 700 or 23% work in foreign operations. Other than in Sweden, none of our facilities are covered by collective bargaining agreements. Talent Attraction We believe that we are part of the future of environmental solutions, and we continue to differentiate ourselves by attracting top talent that brings diverse perspectives, experiences, and expertise that can help solve some of the toughest environmental challenges our clients face. We are focused on attracting and hiring talented and diverse people while at the same time appreciating each candidates’ career aspirations and development areas. Our internal talent acquisition team has decades of experience that spans industries, enabling them to be forward-thinking, strategic, and anticipatory of talent trends. This team performs the majority of the recruiting and hiring by partnering closely with our business leaders and technical teams to understand their current and future talent needs. We have developed and maintained relationships with external search firms to better inform them regarding our business and talent requirements. We leverage these firms for niche and specialized executive, professional and technical roles. We have also advanced our partnerships with select universities by engaging with 20 top-tier universities across the United States and Canada. As part of our engagement efforts in 2023, we met with over 1,000 students, participated in classroom and school panel presentations, and interviewed and hired numerous talented students. We are committed to continuing this initiative with our 2024 spring and fall university relations campaigns. We believe these campaigns can better enable us to identify and hire top talent for our internships and entry-level full-time roles, as well as to develop a strong talent pipeline for years to come. | | | | | Page-14

| | | | | |

|

| | | | | | | | | | | | | |

| | | | | | | | | | | | 2023 ANNUAL PROXY STATEMENT |

(3) | Mr. Jonna, who was appointed to our Board by Oaktree, resigned from Oaktree and our Board effective June 10, 2022. Prior to his resignation, any director compensation that would have been payable to Mr. Jonna was instead paid to Oaktree.30

|

Stock Ownership Guidelines

Our Board believes that, in order to more closely align the interest of our non-management directors with the long-term interests of our stockholders, all non-management directors should maintain a level of equity interests in the Company’s common stock. Under our Stock Ownership Guidelines, all non-management directors (other than any director appointed pursuant to a contractual right, such as that of Oaktree, the holder of our Series A-2 preferred stock) are expected to hold at least five times the annual cash retainer (currently $450,000) in stock or stock equivalents, subject to a five-year phase-in period following our initial public offering in July 2020, or for subsequent appointments, from the director’s date of appointment. As of January 31, 2023, all of the non-management directors subject to the ownership guidelines exceeded or were on track to meet this requirement. See “Compensation Discussion and Analysis” for a discussion of stock ownership guidelines applicable to our executive officers.

2024 ANNUAL PROXY STATEMENT Finally, we prioritize developing relationships and affiliations with professional organizations that promote underrepresented populations and affinity groups, such as the Society of Women Environmental Professionals. We post our career opportunities on various diversity job boards and have expanded our military recruiting initiative. Employee Engagement We actively engage with our employees to help them gain a deeper understanding our business, to provide them with important updates, and to share information about our recently developed patents and acquired businesses. Periodic town halls led by our CEO and quarterly town halls led by our divisional leaders are used to communicate corporate initiatives, reinforce key messages, recognize employee accomplishments and solicit employee feedback. Our monthly newsletter – Montrose Matters – is another communication channel that allows us to highlight projects, provide sustainability updates and recognize employee accomplishments. Finally, we hold annual meetings with our business leaders to provide state-of-the-business updates, as well as to facilitate team building and recognition of accomplishments. In addition to these all-employee events, we have incorporated into our business a number of additional employee engagement initiatives, including: | | • | | Page-15 Implementing an employee engagement solution known as New Leader and Team Assimilation which accelerates the integration, collaboration and engagement of new leaders with their team by following a structured process that allows leaders to share their vision and strategy and better empowers employees to share their expectations about the new leader; and

| |

| • | | For our newly acquired and integrated businesses, conducting post-integration acquisition surveys to gather feedback and identify potential enhancements to our processes. | |

Additionally, we are planning to conduct an Employee Engagement Survey in 2024 to solicit employee feedback and provide an opportunity for increased employee engagement. Employee Training and Development Our employee-centric model is focused on serving our employees and empowering them to grow both professionally and personally. We make investments in a variety of training and development programs, including mentoring, on-the-job and classroom training, and a tuition reimbursement program. Our employees’ ability to grow and learn reflects directly on Montrose; therefore we also encourage our employees to obtain professional licenses and certifications to stay current in their field. Additionally, we also provide in-house compliance-based training, including on our Code of Conduct and Ethics Policy and Anti-Harassment and Cybersecurity Awareness. We regularly review and update our training and development programs to reflect developments in applicable fields, lessons we have learned and employee feedback. We understand that high-potential and high-performing employees want to be part of an organization making meaningful impacts while also advancing their own careers. Investing in our employees’ professional career paths helps create a sense of belonging and is a key pillar of our retention strategy. Our divisional and corporate leaders work closely with their teams to understand each employee’s career aspirations and to support them in career development. Leaders engage with employees to establish goals aligned with their career aspirations, to identify areas for development and to facilitate their professional growth. Goals and development areas are reviewed during year-end performance reviews. We believe this level of engagement and development, with goal setting and development | |

|

| | | | | | | | | | | | | |

| | | | | | | | | | 31 | | 2023 ANNUAL PROXY STATEMENT |

2024 ANNUAL PROXY STATEMENT plans, is critical for talent development and retention. Moreover, we leverage our internal employee Talent Profile tool for employees to document their career accomplishments, certifications and career aspirations. Our employees use our Talent Profiles to source talent throughout the organization for their projects. We conduct organizational talent reviews to assess our collective talent, evaluate macro-organizational trends, identify and mitigate talent risk, identify successorship opportunities, and enable us to have the talent to meet our goals and serve our clients. In 2023, we held robust calibration exercises and talent review discussions with executive and senior leaders across our business, which resulted in action plans designed to further develop, engage, and retain our talent, build successorship, and meet business objectives. Our Board of Directors and its committees are also regularly updated on our organizational talent reviews and talent development efforts as part of their succession planning oversight. Additionally, we conduct periodic 360-degree feedback surveys for our business leaders. These surveys are essential to understanding leadership strengths, development opportunities and the assembly of each leader’s development plan. Employee Retention and Rewards Core to our talent retention strategy is our carefully designed and comprehensive compensation package. We strive to maintain a fair and equitable compensation program for comparable roles, experience and performance that is independent of employee race, gender, sexual orientation, or other personal characteristics. Annually, we conduct a gender pay equity assessment to allow us to provide equitable compensation for employees performing substantially similar work by job and level across all businesses and all corporate functions, regardless of gender. We conduct annual compensation planning, in which business line and corporate leaders evaluate team members for performance-based salary increases and promotions. We also reward employees’ performance with project-based and annual performance cash bonus program opportunities. We offer long-term equity incentives to a number of our employees under our stock incentive plan. We believe strongly in employee ownership of Montrose, and we believe our equity incentives can help to retain employees and create value for our clients, for our employees and for our stockholders. We also believe in recognizing our employees for their contributions. Our leaders have opportunities to identify and nominate employees who have excelled and gone above and beyond their responsibilities and expectations. These employees are recognized individually, in team settings, or by our CEO in broader settings. Globally, we offer country-specific and what we believe are competitive healthcare, life, and disability insurance, retirement programs and paid time-off programs. Diversity, Fairness and Inclusion At Montrose, diversity, fairness, and inclusion (“DF&I”) are key to fulfilling our Company aspirations to be the future of environmental solutions. Our Board’s Compensation Committee has direct oversight of our DF&I programs, priorities, and strategies. Our DF&I strategies are aimed towards promoting a diverse, inclusive, and fair organization and culture that embraces each person’s unique perspectives and differences such as race, ethnicity, gender identification, sexual orientation, age, religion, culture, military status, title or position in the company, geography, educational background or disability. | |

|

| | | | | | | | | | | |

| | | | | | | | | | 32 | | |

2024 ANNUAL PROXY STATEMENT Our DF&I efforts help to identify the inclusion, fairness, and diversity strengths, issues, and opportunities within our business. Our DF&I committee, established in July 2020, is comprised of employees across our various teams, divisions and geographies and is overseen by our SVP of Human Resources. The committee works to build awareness and formalize employee engagement, training, development and policies that support our DF&I goals and initiatives. Our SVP of Human Resources acts as the committee’s executive sponsor, serving as the liaison between the committee and our executive leadership team, works to formalize the committee’s objectives, and increases communications across Montrose. We aim to build positive environments built on mutual respect, equitable access to opportunities, and appreciation for the value each employee delivers to the Montrose team, our clients and our communities. In furtherance of these efforts, we have deployed mandatory inclusion training to our full-time workforce. Our WeLEAD (Women Empowering Leadership) program, which was established in January 2020, is focused on fostering the recruitment, retention and professional development of women at our company. Our WeLEAD program is developing an alliance of women leaders across Montrose, with a key emphasis on mentorship and talent development, and has successfully recommended policy changes that have been implemented to promote the development and retention of female talent within the organization. Further to its mission, WeLEAD coordinates a formal annual mentorship program, with approximately 100 employees participating in the 2023-2024 program. The program provides a structured environment for one-on-one mentorship, along with facilitated small and large group sessions and events, and a regular newsletter providing topics for conversation and supplemental resources. In 2023, we expanded our employee resource groups (“ERGs”) beyond WeLEAD to include BEAM (Black Employees At Montrose) and PRISM (Pride, Recognition, Identity, Solidarity at Montrose). The ERGs aim to develop communities across business lines that facilitate a support mechanism and foster a sense of inclusion, success sharing and mentorship. BEAM is dedicated to creating an inclusive and equitable workplace where diversity thrives and the unique experiences and perspectives of our Black colleagues are celebrated. BEAM’s mission is to foster an environment where everyone feels valued, supported, and empowered to reach their fullest potential. Leveraging the power of collective advocacy and mentorship to shape the future leaders of the Company, BEAM aims to provide essential tools, initiatives and a platform for professional growth in order to propel its members towards excellence in both their careers and environmental stewardship. PRISM is a collective of LGBTQIA+ employees and supportive non-identifying employees - all dedicated to community outreach and advocacy, creating visibility and promoting leadership development. PRISM’s mission is to promote inclusivity and equity regardless of LGBTQIA+ identity at Montrose by partnering with employees, clients, and vendors, participating in PRIDE events and educating others through shared experiences that influence change in language and policies. We continue our efforts to highlight the diverse perspectives of our employees and the celebration of holidays and commemorative periods throughout the year. The DF&I committee released reflections of employees, internally and externally, and educational communications for holidays, heritage months and various dates dedicated to diverse backgrounds and cultures. Our DF&I committee also actively works with our human resources and talent acquisition teams to expand our recruiting efforts of science, technology, engineering and math professionals, as well as engaging with colleges and professional organizations that promote individuals from underrepresented | |

|

| | | | | | | | | | | |

| | | | | | | | | | 33 | | |

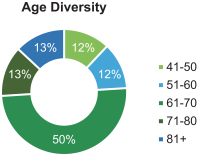

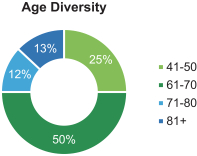

2024 ANNUAL PROXY STATEMENT populations. For example, we have sponsored events for the Society of Women Environmental Professionals to build a long-term relationship. Additionally, the committee, in coordination with our human resources team continues to review our job posting templates for inclusive and fair recruitment language aimed towards facilitating a diverse applicant pool. Further to our DF&I commitments and as part of our sustainability commitments, we have committed to reach gender parity in the workforce by 2040. Community Development Our employees’ dedication to supporting each other has led to the establishment of The Montrose Community Foundation, a non-profit organization formed and operated by our employees for the benefit of our employees. Through its volunteer board, The Montrose Community Foundation uses donations made by employees, board members, clients and others to provide resources to our employees in times of need. Our employees’ dedication of personal time and resources solely for the benefit of their colleagues exemplifies our team-oriented culture. Governance Our human capital strategy is led by our Human Resources function under the direction of our SVP of Human Resources, with active oversight by our Board’s Compensation Committee. The Compensation Committee and Board receive regular updates on human capital matters, including training and development, and related strategic initiatives from our SVP of Human Resources and our executive leadership team. Board and Executive Diversity Our Board of Directors recognizes that diversity is an important factor in providing an appropriate balance of skills, knowledge, experience and perspectives on our Board and in our executive leadership. With the support of our Board, diversity continues to be a focus for recruitment and retention of our workforce and Board members. The following charts reflect the ethnic and racial diversity, age diversity and gender diversity of our Board of Directors. As summarized in “Corporate Governance —Review of Director Nominees”, our Nominating and Corporate Governance Committee and Board consider diversity in evaluation of new board members and seek diverse candidates with skills and experiences to complement and enhance our current Board. | |

|

| | | | | | | | | | | |

| | | | | | | | | | 34 | | |

2024 ANNUAL PROXY STATEMENT

In addition to the diversity of the Company’s Board of Directors, the Company’s named executive officers are from diverse racial and ethnic backgrounds and genders, as reflected in the following charts: Health, Safety and Wellness Our culture of safety and wellbeing of our employees is supported by a dedicated team of health and safety professionals. Across our organization, we demonstrate our strong commitment to the safety of our employees with frequent communications and systems that actively engage employees and encourage all employee’s input and involvement. The foundation of the safety program is designed so that our employees are sufficiently trained to perform their job duties, have properly operating equipment including correct Personal Protective Equipment such as gloves, eyewear and respirators, job hazards are properly identified, mitigated and planned for prior to work commencement, and the entire process is documented to validate and improve performance. All employee time associated with safety preparation and training is fully paid to employees. Current initiatives include driving safety, chemical safety, job safety planning and job hazard analysis. Furthering our commitment to our employees, we employ a third party occupational medical provider that is available to all employees 24/7 to discuss occupational health concerns. Finally, all our employees have complete stop work authority and can stop any project or task if there is any concern about a safety issue without any fear of retribution. Our dedication and commitment to safety have resulted in us again receiving National Safety Council Award for Operational Excellence. | |

|

| | | | | | | | | | | |

| | | | | | | | | | 35 | | |

2024 ANNUAL PROXY STATEMENT The Board of Directors PROPOSAL NO. 1 ELECTION OF DIRECTORS1: Election of Directors

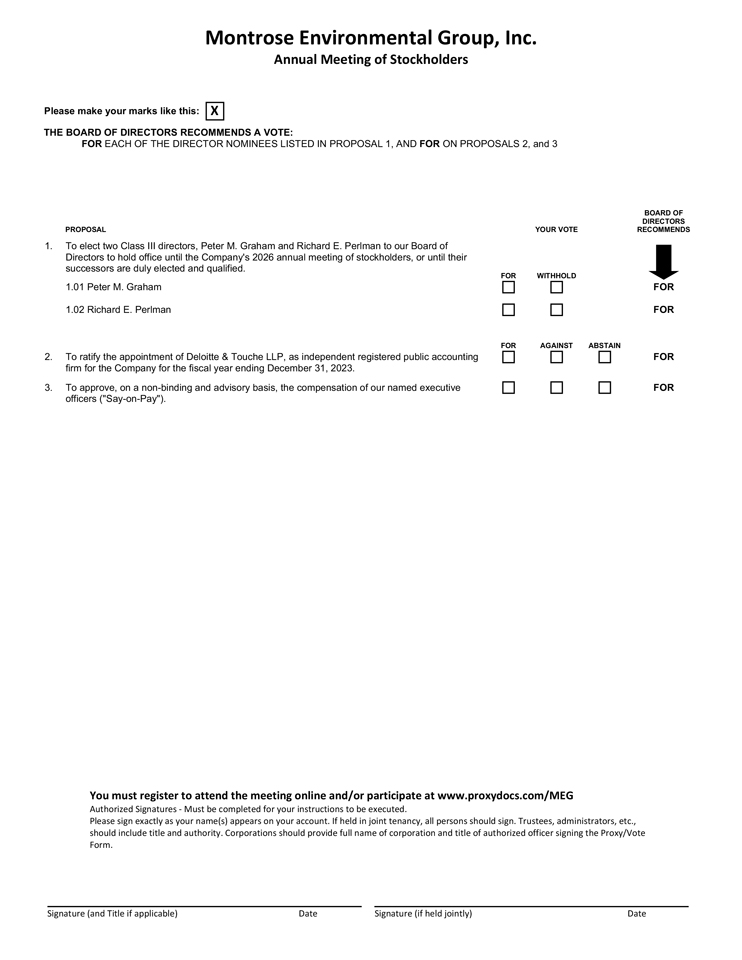

Our Board is divided into three classes, Class I, Class II and Class III, each consisting of as near an equal number of directors as possible. Under our certificate of incorporation, the total number of directors will be determined from time to time by our Board. At present, our Board has the number of directors at nine, with one vacancy and three directors in each of Class I and II, and two directors in Class III. Our directors serve staggered terms according to class, so that only a single class of directors shall have terms expiring in any given year. Those who are elected as directors upon expiration of a term shall serve for a three-year term and until the election and qualification of their respective successors in office, or until the director’s earlier death, resignation or removal. The vacancy relates to a Board seat that Oaktree has the right to fill pursuant to the terms of our Series A-2 preferred stock. Oaktree has not replaced Mr. Jonnaits former appointee on the Board of Directors following his resignation onin June 10, 2022. The current terms of our twothree Class IIII directors, Peter M. GrahamJ. Miguel Fernandez de Castro, Vijay Manthripragada and Richard E. Perlman,Robin L. Newmark, will expire at the Annual Meeting. Our Board has nominated Messrs. GrahamFernandez de Castro and PerlmanManthripragada and Dr. Newmark for election as our Class IIII directors with terms expiring at the 20262027 annual meeting of stockholders. Mr. Peter Jonna, the Oaktree designee, who was a Class III director, resigned from the Board in 2022 and his vacancy has not been filled by Oaktree. Please see “The Board of Directors” below for information about the nominees for election as directors and the current members of the Board who will continue serving following the Annual Meeting, their business experience and other pertinent information. Proxies cannot be voted for a greater number of persons than the number of nominees named. If you sign and return the accompanying proxy card or voting instruction form or vote electronically over the Internet or by telephone, your shares will be voted for the election of the twothree nominees recommended by the Board of Directors unless you choose to abstain or vote against any of the nominees. If any nominee for any reason is unable to serve or will not serve, proxies may be voted for such substitute nominee as the proxy holder may determine. The Company is not aware of any nominee who will be unable to or will not serve as a director. The Company did not receive any stockholder nominations for director for the Annual Meeting. Required Vote Directors are elected by a plurality of the votes cast. This means that the twothree individuals nominated for election to the Board of Directors who receive the most “FOR” votes (among votes properly cast in person or by proxy) will be elected. Abstentions and broker non-votes will not affect the outcome of the election of directors. THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE FOR EACH OF THE THREE NOMINEES. The Board of Directors unanimously recommends that you vote FOR each of the two Nominees.

| | | | | | | | | | | |

| | | | | | | | | | 36 | | | | | | | | Page-16

| | | | | | |

2024 ANNUAL PROXY STATEMENT

| | | | | | | | | | | | | 2023 ANNUAL PROXY STATEMENT |

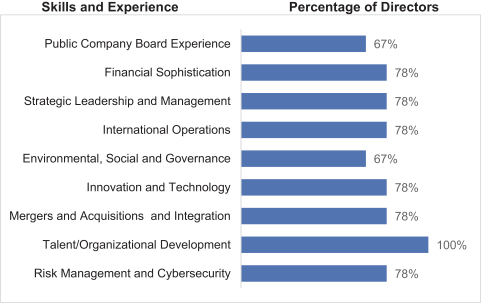

THE BOARD OF DIRECTORS

Overview The Company’s Board of Directors collectively provide a significant breadth of experience, knowledge and ability to effectively represent the interests of stockholders, uphold the Company’s mission and provide a broad set of perspectives. Director Skills and Experience The Board of Directors believes the Board, as a whole, should possess the requisite combination of skills, professional experience, and diversity of backgrounds to oversee the Company’s business. The Board of Directors also believes there are certain attributes each individual director should possess. Accordingly, the Board of Directors and the Nominating and Corporate Governance Committee consider the qualifications of directors and director candidates individually as well as in the broader context of the Board’s overall composition and the Company’s current and future needs. The graphic below illustrates the range of skills, professional experience and diversity of backgrounds possessed by our current directors. Our directors also possess other individual skills, professional experience and background qualifications not depicted in the graphic below.

The Board believes its composition is well-rounded, diverse and independent with the institutional knowledge of longer-tenured directors and fresh perspectives brought by newer directors. Directors have a variety of skills and experiences developed across a broad range of industries which enables effective oversight of the business and aligns with our strategic goals and priorities. Overview of Experience Categories | | • | | Public Company Board Experience –Experience. Director serves or has served on at least one other SEC reporting company boardsboard and has an understanding of the practices and functions of public reporting company board operations and governance matters. | |

| | • | | Financial Sophistication –Sophistication. Director has an understanding of accounting, auditing, tax, banking, insurance, investments, capital structures and/and / or corporate finance activities. | |

| |

|

| | | | | | | | | | | |

| | | | | | | | | | 37 | | |

2024 ANNUAL PROXY STATEMENT | | • | | Strategic Leadership and Management –Management. Director serves or has served in a senior executive position (CEO, COO, CFO or equivalent). |

| | | | | | | | | | | | | 2023 ANNUAL PROXY STATEMENT |

| | • | | International Operations –Operations. Director has experience leading or serving in high-level management positions with companies with operations outside the United States and familiarity with business culture and regulatory framework of non-U.S. operations. | |

| | • | | Environmental, Social and GovernanceGovernance. – Director has experience with environmental, social and governance matters, including climate change risks and opportunities, corporate social responsibility, human capital management, inclusion and diversity, and/and / or corporate culture. | |

| | • | | Innovation and TechnologyTechnology. – Director has experience in research, development, commercialization and/and / or acquisition of innovative technologies. | |

| | • | | Mergers and Acquisitions and IntegrationIntegration. – Director has experience in evaluating, completing and/and / or integrating mergers and acquisitions of businesses. | |

| | • | | Talent/Talent / Organizational DevelopmentDevelopment. – Director has practical experience in recruiting,recruitment, retention, development and compensation of employees, as well as human resources practices, inclusion and diversity programs, and assessment and/and / or development of corporate culture.

| |

| | • | | Risk Management and Cybersecurity –Cybersecurity. Director has experience in risk management and oversight, including cybersecurity. | |

The Nominating and Corporate Governance Committee considers these attributes, as well as others it deems relevant, when conducting searches for new directors, as well as in determining whether to re-nominate an incumbent director or a candidate nominated by a stockholder. As noted above, our Nominating and Corporate Governance Committee is enhancing the skills matrix used to identify skills, experience and qualifications of our existing directors, as well as those of future Board candidates. The following table sets forth the names, ages and background information of the nominees for election as directors and the current members of the Board of Directors who will continue serving following the Annual Meeting, as well as each individual’s specific experience, qualifications and skills that led the Board of Directors to conclude that each such nominee/nominee / director should serve on the Board of Directors. Please refer to Item 1, Business in the Company’s 20222023 Annual Report on Form 10-K for biographical information pertaining to the Company’s executive officers. | | | | | | | | | | | | | | |

|

| | | | | | | | | | | |

| | | | | | | | | | 38 | | | | | | | | Page-18

| | | | | | |

| | | | | | | 2024 ANNUAL PROXY STATEMENT | | | | | | 2023 ANNUAL PROXY STATEMENT |

Class IIII Director Nominees Nominees for Election to a Three-Year Term Expiring at the 20262027 Annual Meeting of Stockholders | | | | | | | | | | | | Name, Skills and Experience | | Age | | Committee(s) | Peter M. Graham

Mr. Graham has been a Director since June 2017. Mr. Graham is a private investor and has been a partner at One Better Ventures LLC, a private advisory and investment company, since June 2017. Mr. Graham served on the board and as chairman of the audit committee of Thrive Acquisition Corporation, a publicly held special purpose acquisition company from September 2021 until January 2023. Previously, Mr. Graham served for seventeen years as chairman of the board of Seventh Generation, Inc., a privately held consumer products company, until it was sold to Unilever PLC in October 2016. Until 2004, Mr. Graham held various positions with Ladenburg Thalmann Group Inc., including Principal, President and Vice Chairman. In addition to serving on the board of directors of a number of public and privately-held companies prior to 2014, including in the role of lead independent director and chair of the audit and compensation committees, Mr. Graham served on the board of directors of ExamWorks Group, Inc. until May 2016, where he served as a member of the audit, compensation and nominating and corporate governance committees.

Mr. Graham’s extensive service on other public and private company boards, including serving as a lead independent director and audit and compensation committee chair, brings important insight and guidance to the Board regarding its responsibilities, including as a public company, as well as best practices in corporate governance. Mr. Graham’s exposure to the investment banking industry contributes extensive knowledge of finance and capital markets to the Board.

| | 68

| | Compensation

(Chair)

Audit

| ✓ Public Company Board Experience

| | ✓ Financial Sophistication

| | ✓ Strategic Leadership and Management

| | | | | | | | | | ✓Environmental, Social and Governance

| | ✓ Risk Management and Cybersecurity

| | | | | | | | | | | | ✓ Talent/Organizational Development

| | ✓ Mergers and Acquisitions and Integrations

| | | | | | |

| | | | | | | | | | | | | 2023 ANNUAL PROXY STATEMENT |

| | | | | | | | | | | | Name, Skills and Experience | | Age | | Committee(s) | Richard E. Perlman

Mr. Perlman has been a Director since December 2013, and Chairman of the Board since July 2019. Mr. Perlman is a co-founder of ExamWorks Group, Inc., a provider of independent medical examination services, and has served as its Co-Executive Chairman since January 2020, and previously served as its Executive Chairman from October 2010 to January 2020. Mr. Perlman is also the Chairman of Compass Partners, LLC, a merchant banking firm specializing in middle market companies, which he founded in 1995. Mr. Perlman’s previous positions include serving as Executive Chairman of TurboChef Technologies, Inc., PracticeWorks, Inc. and AMICAS. Mr. Perlman sits on the boards of various privately-held companies and serves on The Executive Advisory Board of The Wharton School, The Wharton Entrepreneurship Advisory Board and is a part time faculty member of The Wharton School. He is also a board member of The James Beard Foundation and the Boys and Girls Club of Sarasota. Mr. Perlman is a graduate of the Wharton School of the University of Pennsylvania and received his Master of Business Administration from The Columbia University Graduate School of Business.

Mr. Perlman’s qualifications to serve on our Board include his expertise in business and corporate strategy and his strong background with early-stage companies like ours that grew both organically and through strategic acquisitions. His broad experience with other public and private company boards also brings valuable insight and guidance to the Board regarding its responsibilities and best practices in corporate governance. Mr. Perlman’s significant background in banking and other fiscal matters brings meaningful value the Board’s approach to the Company’s financial positioning.

| | 76

| | Compensation

Nominating

and Corporate

Governance

| ✓Committee(s) Public Company Board Experience

| | ✓ Financial Sophistication

| | ✓ Strategic Leadership and Management

| | | | | | | | | | ✓ International Operations

| | ✓ Environmental, Social and Governance

| | ✓ Innovation and Technology

| | | | | | | | | | ✓ Talent/Organizational Development

| | ✓ Mergers and Acquisitions and Integrations

| | ✓ Risk Management and Cybersecurity

| | | | |

| | | | | | | | | | | | | 2023 ANNUAL PROXY STATEMENT |

Continuing Directors

Class I Directors Continuing in Office Until the 2024 Annual Meeting of Stockholders

| | | | | | | | | | | | Name, Skills and Experience | | Age | | Committee(s) | J. Miguel FernandezMIGUEL FERNANDEZ de CastroCASTRO |  | | Mr. Fernandez de Castro has been a Director since December 2013. Mr. Fernandez de Castro has served as Co-Chief Executive Officer of ExamWorks Group, Inc., a provider of independent medical examination services, since January 2020, and as Chief Financial Officer of ExamWorks since March 2009. Previously, Mr. Fernandez de Castro served as Senior Executive Vice President of ExamWorks from March 2009 to January 2020. Before ExamWorks, Mr. Fernandez de Castro served first as Senior Vice President and subsequently | | 52 | | Audit | as Chief Financial Officer and Vice President and Controller of TurboChef Technologies, Inc. Before TurboChef, Mr. Fernandez de Castro held various positions with PracticeWorks, Inc. Mr. Fernandez de Castro began his career in the audit services group of BDO Seidman, LLP. Mr. Fernandez de Castro received a Bachelor of Arts in Economics and Spanish and a Masters in Accounting from the University of North Carolina at Chapel Hill. Mr. Fernandez de Castro is a Certified Public Accountant in the State of Georgia. Mr. Fernandez de Castro’s broad executive finance and accounting experience, as well as his professional accounting background, provide the Board with important expertise regarding accounting, financial and treasury matters. This experience also brings to the Board important depth of knowledge regarding public company reporting. | | 51

| | Audit

| ✓ Financial Sophistication ✓ Innovation and Technology ✓ Risk Management and Cybersecurity | | ✓ Strategic Leadership and Management ✓ Talent / Organizational Development | | ✓ International Operations | | | | | | | | | | ✓ Innovation and Technology

| | ✓ Talent/Organizational Development

| | ✓ Mergers and Acquisitions and Integrations |

| |

|

| | | | | | | | | | | |

| | | | | | | | ✓ Risk Management and Cybersecurity

| | | | | | | | |

2024 ANNUAL PROXY STATEMENT | | | | | | | | | Name, Skills and Experience | | | | | Page-21

Age | | | | | | Committee(s) |

| | | | | | VIJAY MANTHRIPRAGADA |

| | | | | | 2023 ANNUAL PROXY STATEMENT |

| | | | | | | | | | | | Name, Skills and Experience | | Age | | Committee(s) | Vijay Manthripragada

Mr. Manthripragada joined Montrose Environmental as our President in September 2015. In June 2016 Mr. Manthripragada also joined our Board of Directors and, since February 2016, he has served as our President and Chief Executive Officer. Before joining Montrose Environmental, Mr. Manthripragada most recently served as the Chief Executive Officer of PetCareRx, Inc., an e-commerce company, from 2013 to 2015. Prior to PetCareRx, Mr. Manthripragada was at Goldman Sachs where he held various positions from 2006 to 2013. Mr. Manthripragada received his Master of Business | | 47 | | None | Administration from The Wharton School, University of Pennsylvania and his Bachelor of Science in Biology from Duke University. Mr. Manthripragada’s qualifications to serve on the Board include his experience as a president and chief executive officer, which contributes valuable management expertise to the Board’s collective knowledge. Mr. Manthripragada’s Board service also creates a direct, more open channel of communication between the Board and senior management. | | 46

| | None

| ✓ Financial Sophistication ✓ Environment, Social and Governance ✓ Mergers and Acquisitions and Integrations | | ✓ Strategic Leadership and Management ✓ Innovation and Technology ✓ Risk Management and Cybersecurity | | ✓ International Operations ✓ Talent / Organizational Development |

| |

|

| | | | | | | | | | | |

| | | | | | | | ✓ Environmental, Social and Governance

| | ✓ Innovation and Technology

| | ✓ Talent/Organizational Development

| | | | | | | | | | ✓40 Mergers and Acquisitions and Integrations

| | ✓ Risk Management and Cybersecurity

| | | | | | |

2024 ANNUAL PROXY STATEMENT

| | | | | | | | | Name, Skills and Experience | | Age | | | | 2023 ANNUAL PROXY STATEMENT |

| | | | | | | | | | | | Name, Skills and Experience | | Age | | Committee(s) | RobinROBIN L. NewmarkNEWMARK

|

| | Dr. Newmark has been a Director since January 2020. Dr. Newmark was previously Executive Director Emeritus at the U.S. Department of Energy’s National Renewable Energy Laboratory (NREL), the national laboratory advancing renewable energy and energy efficiency technologies, a position she has held sincefrom September 2018 to January 2021 where she led energy analysis and decision support efforts, with prior positions including Executive Director, Strategic Initiatives, from January 2018 to September 2018, Associate Laboratory Director, Energy Analysis and Decision Support, from 2013 to January 2018, Director, Strategic Energy Analysis Center from 2010 to 2013 and Principal Program | | 67 | | Nominating and Corporate Governance (Chair) | Manager, Planning and Program Development from 2009 to 2010. Prior to her work at NREL, Dr. Newmark conducted research in energy, environment, climate and national security, and held several leadership positions at the Lawrence Livermore National Laboratory, a national laboratory specializing in nuclear weapons, national and homeland security, energy and environmental research, including Deputy Program Director, Energy and Environmental Security, Program Leader and Associate Program Leader, Water and Environment and External Relations Director, Global Security. Dr. Newmark co-invented a suite of award-winning environmental remediation technologies, authored over 100 papers and reports in the open literature and holds five patents. Dr. Newmark previously served on the Board of Directors of a nonprofit organization initiated by the Colorado Governor’s Energy Office as a resource and energy efficiency asset for regional and national stakeholders. Dr. Newmark received a Bachelor of Science in Earth and Planetary Sciences from the Massachusetts Institute of Technology (Phi Beta Kappa), a Master of Science in Earth Sciences (Marine Geophysics) from the University of California at Santa Cruz, a Master of Philosophy in Geophysics and a Doctor of Philosophy in Marine Geophysics from Columbia University. Dr. Newmark brings over 30 years of planning and operations experience across the energy and environmental innovation ecosystem to the Board, from foundational research to technology development, validation and entry into commercial markets. Her experience engaging industry partners and public stakeholders in projects provides invaluable expertise and insight to the Board for pursuing our mission and supporting our clients’ environmental needs. | | 66

| | Nominating

and

Corporate

Governance

(Chair)

| | | | | | ✓ International Operations ✓ Talent / Organizational Development | | ✓ Environmental, Social and Governance ✓ Mergers and Acquisitions and Integrations | | ✓ Innovation and Technology | | | | | | | | | | ✓ Talent/Organizational Development

| | ✓ Mergers and Acquisitions and Integrations

| | ✓ Risk Management and Cybersecurity |

| |

|

| |

| | | | | | | | | | | | | | | | | | | 41 | | | | | | | | Page-23

| | | | | | |

| | | | | | | 2024 ANNUAL PROXY STATEMENT | | | | | | 2023 ANNUAL PROXY STATEMENT |

Continuing Directors Class II Directors Continuing in Office Until the 2025 Annual Meeting of Stockholders | | | | | | | | | | | | Name, Skills and Experience | | Age | | Committee(s) | J. Thomas PresbyTHOMAS PRESBY |

| | Mr. Presby has been a Director since August 2016. Mr. Presby is a former partner of Deloitte, where, in his 30 years as a partner, he held numerous leadership positions within the United States and abroad, including ten years in Paris and Central Europe developing Deloitte’s global network. Before retiring in 2002, he served seven years as Global Deputy Chairman and Chief Operating Officer. Following his retirement from Deloitte, Mr. Presby has served on the board of directors and as audit committee Chair of nine other publicly listed companies, including American Eagle Outfitters, Inc., ExamWorks Group, Inc., First Solar, Inc., Greenpoint Financial Corp., Invesco Ltd., | | 84 | | Audit (Chair) Compensation | PracticeWorks Inc., Tiffany & Co., TurboChef Technologies, Inc. and World Fuel Services Corp., as well as several privately held companies. He recently retired from the New York Chapter of the National Association of Corporate Directors after more than ten years of service. Mr. Presby previously served as a trustee of Rutgers University, Montclair State University and as director and chairman of the audit committee of The German Marshall Fund of the United States. Mr. Presby received a Bachelor of Science in electrical engineering from Rutgers University and a Master of Science in industrial administration from the Carnegie Mellon University Graduate School of Business. He is a Life Member of the AICPA. Mr. Presby brings a significant level of financial and accounting expertise to the Board, developed at the highest levels during his more than 30-year career with Deloitte, working with numerous listed companies, as well as his extensive resume of audit committee and audit committee chair service for a number of public and private companies. This experience also provides invaluable insight regarding public company reporting matters, as well as a deep understanding of the process of an audit committee’s interactions with the Board, management and the external auditor. | | 83

| | Audit (Chair)

Compensation

| ✓ Public Company Board Experience ✓ International Operations ✓ Talent / Organizational Development | | ✓ Financial Sophistication ✓ Innovation and Technology ✓ Risk Management and Cybersecurity | | ✓ Strategic Leadership and Management | | | | | | | | | | ✓ International Operations

| | ✓ Innovation and Technology

| | ✓ Mergers and Acquisitions and Integrations |

| |

|

| | | | | | | | | | | |

| | | | | | | | ✓ Talent/Organizational Development

| | ✓ Risk Management and Cybersecurity

| | | | | | |

2024 ANNUAL PROXY STATEMENT

| | | | | | | | | Name, Skills and Experience | | Age | | | | 2023 ANNUAL PROXY STATEMENT |

| | | | | | | | | | | | Name, Skills and Experience | | Age | | Committee(s) | JamesJAMES K. PricePRICE

|

| | Mr. Price has been a Director since December 2013. Mr. Price is a co-founder of ExamWorks Group, Inc., a provider of independent medical examination services, and has served as its Co-Executive Chairman since January 2020. Previously, Mr. Price served as Chief Executive Officer of ExamWorks from October 2010 to January 2020, and as Co-Chairman of the Board and Co-Chief Executive Officer of ExamWorks from 2008 to 2010. Before ExamWorks, Mr. Price served as President, Chief Executive Officer and director of TurboChef Technologies, Inc. and as President, Chief Executive Officer and a director of PracticeWorks, Inc. Mr. Price was a co-founder of AMICAS, Inc. and served | | 65 | | Compensation Nominating and Corporate Governance | as its Executive Vice President and Secretary. Mr. Price has served as an executive officer of American Medcare and also co-founded and was an executive officer of International Computer Solutions. Mr. Price sits on the board of directors of several privately-held companies and non-profit organizations. Mr. Price holds a Bachelor of Arts in marketing from the University of Georgia. Mr. Price’s qualifications to serve on our Board include his expertise in business and corporate strategy and his strong background with early-stage companies like ours that grew both organically and through strategic acquisitions. Mr. Price’s extensive resume as the chief executive officer of other companies also contributes valuable executive and management experience to the Board’s collective knowledge. His broad experience with other public and private company boards also brings important insight and guidance to the Board regarding its responsibilities and best practices in corporate governance. | | 64

| | Compensation

| ✓ Public Company Board Experience ✓ International Operations ✓ Talent / Organizational Development | | ✓ Financial Sophistication | | ✓ Strategic Leadership and Management

| | | | | | | | | | ✓ International Operations

| | ✓ Environmental, Social and Governance | | ✓ Innovation and Technology

| | | | | | | | | | ✓ Talent/Organizational Development

| | ✓ Mergers and Acquisitions and Integrations | | ✓ Strategic Leadership and Management ✓ Innovation and Technology ✓Risk Management and Cybersecurity |

| |

|

| |

| | | | | | | | | | | | | | | | | | | 43 | | |

2024 ANNUAL PROXY STATEMENT | | | | | | | | | Name, Skills and Experience | | | | | Page-25

Age | | | | | | Committee(s) |

| | | | | | JANET RISI FIELD |

| | | | | | 2023 ANNUAL PROXY STATEMENT |

| | | | | | | | | | | | Name, Skills and Experience | | Age | | Committee(s) | Janet Risi Field

Ms. Risi has been a Director since October 2021. Ms. Risi currently serves aswas previously President and Chief Executive Officer of Independent Purchasing Cooperative, an international supply chain management organization she founded in 1996.1996, until December 2021. Prior to founding Independent Purchasing Cooperative, Ms. Risi was a commodities buyer for Ralston Purina and held a number of other positions within the food industry. Ms. Risi also serves on the board of directors for several private companies and charitable organizations. Ms. Risi received a B.A. in English and a minor in Business from | | 64 | | Nominating and Corporate Governance | DePauw University. Ms. Risi’s qualifications to serve on our Board include her experience founding and growing a successful, international business, which is particularly helpful as we grow our business further and expand internationally, as well as her extensive executive and leadership skills gained over the course of her professional career. Ms. Risi’s service on other public and private company boards, including serving as a compensation committee chair of a public company, brings important insight and guidance to the Board regarding its responsibilities and best practices regarding executive compensation. | | 63

| | None

| | | | | | ✓ Public Company Board Experience ✓ Talent / Organizational Development | | ✓ Strategic Leadership and Management ✓ Environmental, Social and Governance | | ✓ International

Operations ✓ Innovation and Technology |

Class III Directors Continuing in Office Until the 2026 Annual Meeting of Stockholders | | | | | | | | | Name, Skills and Experience | | Age | | Committee(s) | PETER M. GRAHAM |

| | Mr. Graham has been a Director since June 2017. Mr. Graham is a private investor and has been a partner at One Better Ventures LLC, a private advisory and investment company, since June 2017. Mr. Graham served on the board and as chairman of the audit committee of Thrive Acquisition Corporation, a publicly held special purpose acquisition company from September 2021 until January 2023. Previously, Mr. Graham served for seventeen years as chairman of the board of Seventh Generation, Inc., a privately held consumer products company, until it was sold to Unilever PLC in October 2016. Until 2004, Mr. Graham held various positions with Ladenburg Thalmann Group Inc., | | 69 | | Compensation (Chair) Audit | including Principal, President and Vice Chairman. In addition to serving on the board of directors of a number of public and privately-held companies prior to 2014, including in the role of lead independent director and chair of the audit and compensation committees, Mr. Graham served on the board of directors of ExamWorks Group, Inc. until May 2016, where he served as a member of the audit, compensation and nominating and corporate governance committees. Mr. Graham’s extensive service on other public and private company boards, including serving as a lead independent director and audit and compensation committee chair, brings important insight and guidance to the Board regarding its responsibilities, including as a public company, as well as best practices in corporate governance. Mr. Graham’s exposure to the investment banking industry contributes extensive knowledge of finance and capital markets to the Board. | | | | | | | | | | ✓ Talent/Organizational DevelopmentPublic Company Board Experience | | ✓ Environmental, Social and Governance ✓ Talent / Organizational Development | | ✓ InnovationFinancial Sophistication ✓ Risk Management and

Technology ✓ Mergers and Acquisitions and Integrations | | ✓ Strategic Leadership and Management |

| |

|

| | | | | | | | | | | |

| | | | | | | | | | 44 | | |

2024 ANNUAL PROXY STATEMENT | | | | | | | | | Name, Skills and Experience | | Age | | Committee(s) | RICHARD E. PERLMAN |